By John_Mauldin | 7 October 2007

The market certainly seemed pleased with the new jobs number. The glass is more than half full— or is it? Fed Vice-chairman seemed to suggest that the economy was getting better and the Fed might not need to make any further rate cuts. Is it now "One (Cut) and Done?" This week we look at what employment growth tells us about the growth of the US economy, spend some more time looking at how a fall in home prices will affect consumer spending, and muse on whether the Fed is indeed done cutting. We look at the scariest headline I have read in the Wall Street Journal in years.

Why 110,000 Jobs Are Not Enough

First, let's look at the good news in the employment report. Average hourly earnings are up by 4.1% over the last year, and growing at a 5% compound rate for the last few months. That is the strongest earnings growth in a long time. It suggests that consumer spending should be fine over the next few months.

Second, jobs growth came in at 110,000 new jobs, 10% higher than the 100,000 that was expected. But the good news was that July and August were revised up substantially. August, which was initially thought to be down 4,000, was revised upward to a positive 89,000. That is a very nice swing. Most of the revision came from new government jobs, and most of those in education [[this is likely a statistical fluke due to jurisdictions changing their school starting and ending times: normxxx]].

I should note for the record that the monthly payroll report is probably the single most misleading statistic that the government puts out. The numbers, as illustrated above, are subject to massive revisions. Often they are adjusted (up and down) by several hundreds of thousands of jobs a year later, but no one pays attention to year-old news. Those revisions don't make the headlines. Over time, the revisions get it right, but the current-month numbers must be taken with more than a few grains of salt.

Now, let's look at why the glass may be half empty. If the jobs number came in over the past few years at 110,000, it would be considered a very weak number. The economy needs between 150,000 and 200,000 new jobs each month to simply maintain the employment level, as we add that many new job seekers each month.

Over the last three months, the new jobs number has averaged 97,000, which is down 25% from the previous three-month increase of 126,000. Not a good trend. Since last May, the number of unemployed has risen by 400,000, while the government has taken 200,000 people off the rolls of those looking for a job. In other words, there are 200,000 people who were looking for a job in May who are not looking for one now. If you are not looking for a job, you are not counted as unemployed. This methodology holds down the headline unemployment rate.

Private businesses only created 73,000 new jobs. And 58,000 of those were in healthcare and the food service industry, most of which are not high-paying jobs. Retail and finance shed some 19,000 jobs. And temporary jobs continued to decline, with another 20,000 jobs lost. Temporary jobs are one of the few "leading indicators" in the jobs data, and it is suggesting things are slowing down.

Data maven Greg Weldon ( http://www.weldononline.com ) notices some interesting items in the data:

- "... [after he discussed the strong earnings] we note that the jobs being created are NOT the highest paid jobs. Indeed, we can combine the various aspects of the report to suggest the following ... more young women, and more older women, are finding work in hospitals, day care centers, doctor's offices, and nursing homes, along with schools, and restaurants-bars, representing an overwhelming percentage of new jobs being created.

"Why do we say this??? Note the following data-details as they relate to a breakdown of unemployment rate by age and sex:

"Women 18-19 Years Old ... showed, BY FAR, the largest decline in unemployment, with the rate for this age-sex group plunging from 14.0%, to 12.4% during the month of September, a HUGE single month decline.

"Women Over 55 Year Old ... unemployment rate of 3.0% ... down from an already low 3.4% in August.

"And, when we combine the occupations listed above (hospitals, day care centers, doctor's offices, nursing homes, bars-restaurants, and schools) we come up with a total of 97,500 newly created jobs in these industries alone, accounting for nearly 89% of ALL new jobs created in September."

The overall unemployment rate rose to 4.7%, some 0.3% above the current cycle low of 4.4%. A rise in the unemployment rate often (but not always) signals a recession is in the future. If the economy continues to create only an average of 100,000 new jobs, the unemployment rate is going to rise. That is simply a statistical fact. Without a turnaround in jobs, a serious slowdown and a recession is in our future.

To put that in some context, let's turn to John Hussman, who gives us this rather poignant insight as to how a recession happens. ( http://www.hussmanfunds.com/wmc/wmc071001.htm ) Writing this week, he says:

- "While recessions are often viewed as if there is some 'representative consumer' that just backs off for a while, that sort of chararacterization doesn't fit the facts at all. Though consumption represents about 70% of GDP, it is also the smoothest component of the economy (Friedman and Modigliani were right on this). Indeed, nominal consumption has never declined on a year-over-year basis, even in recessions.

"Recessions are not caused by a general shortfall in spending, but instead by a mismatch between the mix of goods and services supplied by the economy and the mix of goods and services demanded. Though demand shifts away from some kinds of output that the economy produced in the prior expansion (as we saw with tech and telecom in 2000-2002 and are seeing in housing today), we often see continued demand in other sectors, but the mismatch takes time to correct, and output and employment suffer as a result. Most job losses during a recession are typically concentrated in a small number of industries, while other industries experience growth and even growing backlogs and rising employment. So the next recession, whenever it occurs, will probably feature a good amount of dispersion. Most likely, we'll observe particular weakness in housing-related industries (and associated finance sectors), while a variety of sectors including technology, oil services, broadband telecommunications, and consumer staples may be better situated (though such stability still may not prevent stock price weakness)."

One of my favorite sources of information has come to be Charles Dumas and his associates at Lombard Street Research, based in London. (http://www.lombardstreetresearch.com )

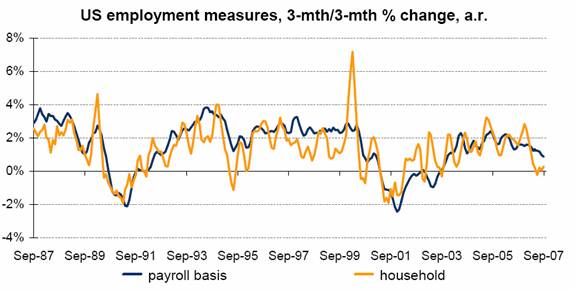

He writes that the employment data suggest the US is on the brink of recession and may already imply a hard landing. In the paragraph below, he talks about the relationship between the two estimates of employment put out by the government (the payroll survey and the household survey) and their relationship to GDP.

- "You need rose-coloured spectacles— to ignore the blue and the orange— or the black and the grey— in the chart below to get bullish. It is not in the recession zone— but it is not in the trend-growth zone either, let alone a strong economy. Depending on the period chosen, last 50 years or last 20 years, US average growth has been 3 1/4% or 3%, respectively. Payroll jobs growth has averaged more than half that, 2% or 1.6%. The sensitivity of payroll jobs growth to variance in GDP growth has been about two fifths: i.e., 1% faster or slower jobs growth for every 2 1/2% upside or downside of GDP growth from its average or trend. On this basis, recent payroll jobs growth at or below a 1% rate imply real GDP growth has been around 1%."

Click Here, or on the image, to see a larger, undistorted image.

Charles goes on to show the relationship between GDP and the payroll employment numbers shows that the economy may be slowing even more.

- "The payroll number is consistent with GDP growth that is scarcely above zero. Our GDP growth estimate for Q3 and forecast for Q4 are in the 1 1/2% region. When the Christmas bonuses come in significantly down, and house prices are seen to be falling even for actual transactions— and even in East Hampton— we expect conditions then to worsen."

Let's recall what John Hussman said earlier about recessions being caused by a mismatch between the goods and services supplied to the economy and the demand for goods and services. In past recessions, this has generally come to a culmination and a point where employment turns down relatively quickly and profits take a dive.

Let me offer a scenario where it might be different this time. In past recessions, there were generally some portions of the economy that grew beyond the respective demand for their products or services and/or a bubble in some sector burst. Such an event happened relatively quickly, and it took some time for there to be a shift of employment to other sectors and the economy to start growing again.

If we see a recession ahead, it is going to be because of the bursting of the housing bubble. But housing is different. There is no "mark-to-market" pricing. You can't look up the value of your house on a computer screen like you can your stocks or bonds. People tend to think their houses are special. They know how much time and effort they put into maintaining the house, and experience has taught them that over time, if they are patient, they will get a good price for their home. They become extremely reluctant to sell at a reduced price.

Enter reality. Home values are starting to fall, and in some areas by a lot, for several reasons. First, because homebuilders are cutting prices in order to move inventory off the market. They have to raise cash in order to pay back loans, even if it means losing money on the sale of homes. They are in survival mode.

D.R. Horton, the second biggest homebuilder, recently sold a San Diego home at auction for 37% less than the asking price. This was the price that homebuyers had been paying in 2006. And in San Diego, it was probably an adjustable-rate mortgage with a low introductory rate.

Hovnavian sold some 2100 homes nationwide last month in its "Deal of the Century" sale. Hovnanian spokesman Jeff O'Keefe said the company offered discounts as high as 30%. That means 30% less than what someone paid last year for the same home down the street.

A story on Bloomberg notes that some smaller home builders are selling homes at a 40% discount in order to raise cash. D.R. Horton put 58 condominiums up for auction in San Diego. Local real estate agent Steven Moran said, "I ran the numbers and the condos sold for between 68 cents and 74 cents on the dollar based on the original asking prices."

The fact that some homebuilders may lose money is not a problem for the general economy. The problem is that anyone trying to sell or refinance a home in one of those neighborhoods is now going to see the value of their home come down— perhaps substantially— in the appraisal they will need for the mortgage. Appraisers look at recent sales of comparable homes to come up with a value for the home. If your neighbor's home sells for 20% less, then your appraisal is going to come down 20% as well. And the amount of money you can borrow on your home depends upon that appraisal.

Ok, then you can just stay in the home and make that mortgage payment. And if you made a conventional loan, that's what you would do. You might not like the fact that your home was worth less, but you wouldn't go through bankruptcy and risk your other assets by not making the payments.

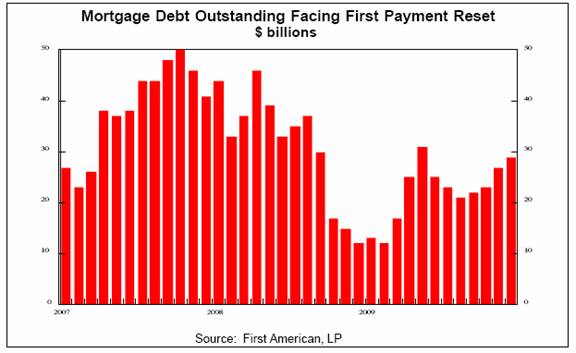

Except for about 2,900,000 home buyers who did not get conventional mortgages. Look at the chart below from good friend Gary Shilling. ( http://www.agaryshilling.com )

- "Subprimes leaped to $1.3 trillion, or 73% of all Adjustable Rate Mortgages (ARMs), in the first quarter, a 17 times jump from 2001. And 57% of mortgage broker customers with ARMs were unable to refinance into new loans in August, given their low initial down payments and falling prices that have put their equity in negative territory. Estimates are that the cumulative loss on subprime mortgages will be $164 billion in home equity and cost financial institutions $300 billion."

Click Here, or on the image, to see a larger, undistorted image.

As these subprime mortgages hit their reset periods and the mortgage payment goes up, many homeowners who were expecting to be able to refinance their homes are not going to be able to, as the value of their homes will be below what they owe on their current mortgages. In a lot of cases, they will not be able to make the higher payment, which can rise by over a thousand a month. They can either simply put up with the higher payment if they are able, or walk away from the mortgage. Not everyone will be in that predicament, but about 20% of recent subprime borrowers are expected to end up in foreclosure.

Now, government officials say they want lenders to work with borrowers to come up with ways to allow homeowners to keep their homes. In a rational world, a lender is better off taking a 20% loss and keeping someone in the home than losing 40%. The problem is, how does a distressed homeowner negotiate with the CDO (Collateralized Debt Obligation) which owns their mortgage, which is in turn owned by European institutions or the Chinese government?

The original mortgage bank, if it still exists, is simply servicing the loan. More than likely, they even sold off the servicing of the loan, as that is not a high-margin business. There are now 161 mortgage banks that are either bankrupt or with their lending ability severely impaired.

Hundreds of thousands of homes are going to come back onto the market in the form of foreclosures over the next year. Those of us who live in Texas have seen this movie before.

The Texas Chainsaw Massacre

It was in the late '80s and early '90s when oil prices collapsed and the S&L crisis hit. There was blood in the streets. Can you say Texas Chainsaw Massacre? Large banks that had made loans to oil businesses and real estate developers saw their collateral evaporate. But they had to keep up their required reserve margins. Since they could not get money from the bankrupt creditors, they called loans in from the creditors who had money, even though it put many of these good businesses into severe crisis.

I had more than one friend who thought he had a solid business watch it go under as his banking relationship and his access to capital seemingly vanished overnight. It was quite sad. Texas banks simply did not have the money to lend to businesses. In the end, every major Texas bank was bought by a "foreign" bank from New York, California, or North Carolina.

The local recession also meant the unemployment rate shot up. The number of homes that went into foreclosure went through the roof. I bought a home for about 40% of the asking price just two years before. But in order to sell the home I was in, I had to bring a check to the table for about 15% of the value, and that was after we had made payments for six years and a sizeable down payment. But that was typical for the time.

It was worse in Houston, the center of the oil industry. Homes were selling on the courthouse step for less than you could get in rent in just a year. People literally bought them with credit cards. What we went through was unthinkable just a few years earlier.

I do not think things will get that bad in the US. But in some markets, you are going to see home values drop by 50%. The more homes that were bought by "investors" who were planning to flip them, the deeper the losses will be in that area. Most parts of the US did not experience such a bubble. But even those areas will suffer because of the ARM subprime loan problems, as more homes will come onto the market due to foreclosures.

Just as with the home crisis in Texas almost 20 years ago, it will take several years to go through the cycle. We have just begun. This process is going to play out over the next 15-18 months. You cannot take 10-15% of the potential home buyers out of the market (due to no subprime availability) and not expect prices to fall [[and, substantially: normxxx]]. Additionally, you cannot triple the supply of homes without expecting prices to fall. We only had a four-month supply of homes for sale in 2005. It is now at ten months and on its way to at least 12. Shilling thinks it goes to a 14-month supply.

When you both slash the number of available buyers and triple the supply, to think we can get by with a simple 10% price adjustment that will correct within less than a year is not credible. And I am making the optimistic assumption that the jumbo loan mortgage market comes back in the next few months, as people who can afford more expensive homes typically have excellent credit and the ability to make meaningful down payments. Sources for these loans should hopefully come back to the market soon.

But it is going to take time. Just as the housing correction is going to feel like it is going in slow motion, the accompanying effect on the economy is also going to feel like slow motion. Hence, a Slow Motion Recession that will take longer to work out of, but probably not be all that deep.

One and Done?

Fed Vice Chairman Donald Kohn, in a speech in Philadelphia, said the economy will return to "moderate" growth after "near-term weakness" and avoided any indication the Fed is preparing to lower rates a second time. The market, which had priced in an almost 100% chance of another rate cut, dropped that wager to a 50% chance on the combination of Kohn's statement and the stronger than expected jobs report.

As noted above, under normal circumstances this jobs report would be considered weak. Housing problems and the damage they will visit upon the economy are not going away. The Fed did not cut rates at the last meeting on a whim. They see problems and will cut again as the economy softens.

They want long-term rates and especially mortgage rates to come down. Lower mortgage rates will help stem the housing valuation slide, as lower rates make homes more affordable. The last cut did not lower rates. Ten-year bond rates were up by almost 13 basis points today. The Fed is going to work to lower rates to attempt to counter a slowing economy. Count on it.

Republicans for Protectionism

There it was on the front page of the Wall Street Journal, the headline that is my worst nightmare. I have said repeatedly that after we work through this slowdown/recession, I think we are going to see a major economic growth cycle and an accompanying powerful bull market. The only thing that would make me turn truly pessimistic is a wave of trade protectionism. So let me quote the first paragraph from Thursday's Journal:

- "By a nearly two-to-one margin, Republican voters believe free trade is bad for the U.S. economy, a shift in opinion that mirrors Democratic views and suggests trade deals could face high hurdles under a new president."

Clearly the rhetoric of protectionism, the pandering of politicians from both parties, and all the media attention on those who have lost jobs to foreign competition are having an effect. Those who believe in free trade are going to have to do a better job of getting the message out, and making sure that those who do lose out to foreign competition are helped to adjust to a new world.

Competition is not going to go away. But if we start restricting imports, we cannot expect our foreign trade partners to sit idly by. Competitive trade wars are terribly destructive. Let's hope we do not go down that road.

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment