Lessons From The Great Depression Part XIII.

Facing Our Own Economic Pilgrimage.

Click here for a link to complete article:

By Dr. Housing Bubble | 3 July 2008

With the systemic problems facing the United States and now being officially in bear market territory, this will be a challenging holiday weekend for many Americans. Already many are planning to curtail any major traveling and are opting to stay at home and possibly doing a barbeque at home because of high fuel costs. Aside from the high cost of fuel, Americans are feeling the pinch of a demoralizing housing market that is causing equity to evaporate as each day goes by. The wealth effect is in full onslaught impacting the psyche of the American consumer. That ever resilient consumer is finally showing an Achilles Heel.

Americans are spending more money on basic necessities and moving away from all things real estate. Nothing can demonstrate this contrast more than comparing Family Dollar Store and Home Depot performance for the year:

Click Here, or on the image, to see a larger, undistorted image.

Family Dollar Stores operate in 44 states and have 6,400 stores. They normally sell daily items for the house including food, cleaning and paper products, home décor, beauty products, toys, pet products, automotive items, and electronics. They cater to a lower income bracket in our population but are showing surprising strength. Just look at the above graph and nothing can highlight this more. Family Dollar Stores are up 14.14% for the year while Home Depot is down 16.41% for the year. What does this signify? It means families are spending more and more on cheaper daily cost of living items and foregoing big-ticket items. Expect this trend to continue. A family is going to put food on their table before putting a granite countertop in the kitchen.

Oil now seems to be taking the main stage as the topic du jour. I was watching CNBC after the market closed today and the progression of stories seemed to play out as follows: Oil, GM, Iran, Iraq, and finally housing. Keep in mind that the reason the dollar is falling is because of the horrific fiscal mismanagement which was played out in the world credit markets, much of it linked to real estate. In fact, real estate was the vector to spread the disease that is infecting the global economy.

Don’t Tase Me Broad

Eli Broad, the billionaire founder of KB Home and 'philanthropist' is now sounding like a doom and gloomer. Earlier this week Broad came out stating that "this is worse than any recession we’ve had since World War II." As more and more people jump into the bear camp, Broad also mentioned that investors would be "better off in cash" although what form of cash he did not specify:

|

I think the point of "safety nets" is important because I’m starting to see this argument take hold. Instead of people denying the recession they are now trying to discuss the magnitude of the recession [["Well, of course we are in a slight recession/growth recession— but nothing to worry about! ": normxxx]]. I’ve read a few people that make the point that we will not face problems like those that we had during the Great Depression because of 'safety nets'. Now unless you’ve been living under a rock, we are [already] having major problems:

*Click to watch brief clip

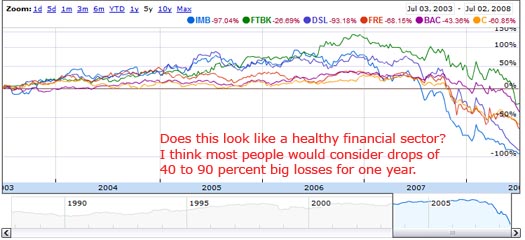

There are a growing number of homeless people. In fact, we have a few tent cities here in Southern California. How is this not a problem? Where is the safety net here? Also, they are telling us that no banks are imploding as they did during the Great Depression. Oh really?

Click Here, or on the image, to see a larger, undistorted image.

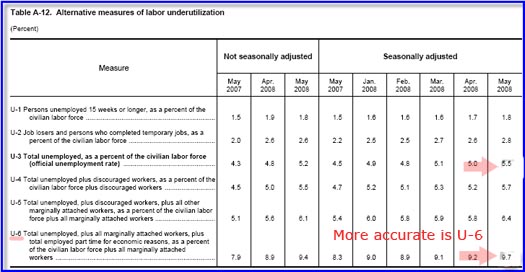

Unemployment in California is at 6.8%. If we actually look at the details of the BLS report more carefully, the national unemployment rate is nearer 10%:

Click Here, or on the image, to see a larger, undistorted image.

Just because we won’t live through the exact same things as the first Great Depression doesn’t mean that this economic downturn will be a walk in the park. Try asking someone that has lost their job, has been blocked off from all access to credit, and has run out of unemployment benefits, how easy things are. This is a tough economy and things will only get worse. You have to remember that during that time, the stock market crashed in October of 1929 yet the market bottom was in 1932. Many banks failed after 1932 [[most banks failed during 1930 - 32: normxxx]]. You can view the stock market as a leading indicator of what will happen to main street, although many on main street are already feeling the pain.

This will be Part XIII in our continuing Great Depression series. Given that this year will showcase a very crucial election, I think it would serve us well to look at some key aspects of the inaugural talk of Franklin Delano Roosevelt in 1933. Amazingly you will find some of the rhetoric to the point and downright brutally honest.

|

|

Can you imagine any politician having the backbone to tell the American people this in our modern era? Most of the same problems hold. Values have shrunken. All levels of government face massive shortfalls in tax revenue. Income is hurting. In fact, there is nothing Pollyanna about this speech except the ability to confront the brutal facts of reality. Whatever your perspective both economically or politically, he was able to tell people the reality of the situation unlike Hoover who was trying to maintain the decadence and falsehood of Coolidge prosperity which was fast fading with each day of the Great Depression. Of course Hoover wasn’t to blame for the depression, just as Bush isn’t solely to blame for our current economic hardships, but make no mistakes, both sat idly by and did absolutely nothing [[for the average American: normxxx]] as Wall Street raided/raids the American piggybank and left/leaves the public holding the bag.

My belief is this is a once in a generation economic struggle. Time has sufficiently passed from the Great Depression that [most] have forgotten the lessons taught to us. The Gramm-Leach-Biliey Act repealed the last safeguards in 1999, nearly 66 years later. I suppose enough time had passed to think human nature had somehow evolved. But, let us continue with the inauguration:

|

The money changers? Talk about taking it to the source. Instead of raking Hank Paulson and Ben Bernanke over their lack of backbone in helping the dollar, they have allowed them to continue on their current path. They have done nothing to help the dollar! You feel poorer because these people are allowing the depreciation of your currency with no intervention. They have the ability to raise rates but won’t. Low rates and lax enforcement of minimal lending standards got us into this mess and apparently they think this will still get us out.

Paulson is now calling for more power for the Fed. Bwahahaha! You have got to be kidding me. Clearly in FDR's talks he was making a biblical parallel with the money changers but how many people would get that reference now-a-days? You’d have to say something like, "we will need to throw out the free loaders from the Real World home and vote Ben Bernanke off the island. Please text your vote on your iPhone now!"

|

Clearly times were so tough, that many people psychologically were ready to commit to a new form of living their lives. The decadence of the Roaring 20s had brought on a major hangover and many were ready for the morning after remedy. We live in a similar parallel. Can you do without your Hummer? Do you really need three cars for your household? Must you have that plasma TV and put it on your credit card? Is consumption at the mall really the pinnacle of success for our country? Can you forego the family vacation this year? Do you need that McMansion? We have been on a once in a lifetime spending binge and we’ve just mortgaged our future for it. Was it worth it? Many people will be asking these questions at the kitchen table.

M O R E. . .

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment