By David Nichols | 9 April 2008

Gold is one of the best markets for trading because its patterns are usually clear and uncomplicated, with prices following the expected fractal path with a great deal of precision. This happens because the underlying conditions in the gold market change at a relatively slow pace, as opposed to the more rapid information flow in equity markets. This allows gold to develop its patterns more endogenously, where equity patterns are constantly buffeted by exogenous forces. In my experience, endogenous patterns allow much greater forecasting precision. In equities, market fractal patterns are also there, but they are significantly noisier, and the short-term moves can be quite exaggerated.

The recent spike top in gold above $1,010, and the accelerated weakness off $992— as well as the sudden drop from $940— $882— are pertinent recent examples of how gold moves predictably at critical times. So when a pattern veers off into more complicated territory— as this new down pattern could be doing now— it's important to recognize when that's happening so we can adjust our strategy.

In the current case, long positions may come right back into the picture if gold can prove this isn't merely a rebound in a bigger down pattern. At this point I still think it's just a counter-trend bounce, and there will be significantly more pressure on gold bulls prior to the next major buying opportunity. It's important not to dogmatically hold on to that opinion if the market is suggesting otherwise.

But we won't know if this is a serious upside move until gold survives another situation that could easily "snowball" into another free-fall decline. In other words, gold has 'to prove' that it can survive another downside scare, and that it won't again fall like a rock. Only then can we deem it safe to go back into significant long positions. The sell-offs in gold are so brutal— and so fast— that it pays to be cautious at turning points. Since we just got out at $992, it's essential that we protect those profits for the next major buying opportunity, and avoid putting ourselves in harm's way.

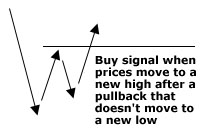

This is also the rationale behind my buy signals, because if such a signal triggers then by definition the market is proving that the reversal is not just a counter-trend bounce. So right now we need to see gold hold on during a downside move, and not go crashing down to new lows. More specifically, this current pattern will need to survive a hard test down to the $910 area before we'll know that prices are really ready to go back up in earnest.

This is also the rationale behind my buy signals, because if such a signal triggers then by definition the market is proving that the reversal is not just a counter-trend bounce. So right now we need to see gold hold on during a downside move, and not go crashing down to new lows. More specifically, this current pattern will need to survive a hard test down to the $910 area before we'll know that prices are really ready to go back up in earnest.

If gold crashes down to $910 and bounces strongly, then that will be a sign of real strength, and long positions can be entered on an hourly buy signal from there. (I'll go over this in my daily reports in more detail if it starts to play out like this.) Then if gold moves up to a new high— particularly a breakout move over the critical $940 area— then we can double that initial position.

The bearish scenario would be if gold slices right through $910 and keeps on going. Then a quick free-fall to $852 is in the works, and we'll want to stand aside until gold hits bottom around $852. As always, I'll keep subscribers updated in my daily reports if there are any changes in this outlook.

ߧ

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment