By Doctor Housing Bubble | 11 December 2007

Most will agree that as a society, we cannot spend our way into prosperity. In fact, many of even the most ardent bulls will acknowledge that we have some serious issues to address in our current economy. From preliminary reports, this rate freeze will have a very minimal impact on the overall housing market. Keep in mind that we have yet to see the plan in action since the first rate resets to take effect will not occur until 1/1/2008. The proposal at best is an avenue for a cathartic release from the housing doldrums and gives those in the industry a respite to scream "let us gasp for air!" It seems to have worked. Housing related stocks are up and with the prospect of further rate cuts, all seems well until you start facing the brutal reality of what is occurring.

Jim Collins in his book Good to Great examines the successful traits of prosperous companies. His focus wasn’t on high flying companies that made a torrent of money and suddenly crashed. He looked at the attributes of sustainable and successful companies. He offers various characteristics of these companies such as choosing the right people from the beginning, focusing on your core strengths, and also having the ability to confront the brutal facts. The last point seems rather harsh and down right pessimistic. Yet the essence of facing the brutal facts is optimistic because you cannot move on to greater and better things until you first address the underlying issues/problems. In psychology 101 we learn that a prerequisite to having a healthy mental state is being able to confront our demons not with fear but with courage. Once we face up to what is at the root of the problem we can start to progress and live a healthier life.

So what does this have to do with the mortgage crises? It actually has a lot to do with it. We currently live in a society that is repressed on economic issues. Instead of being attacked at the root (which would require enduring some pain now in order to gain future benefits), some nostrums and palliatives are being prescribed for the impending credit crises to make the current pain more bearable. Even the term "rate freeze" provides the perception that all is well for the moment and we’ll deal with the problem at a later date. Yet this perception avoids the true difficulty: that we are in a historical credit bubble that can only be solved by a substantial correction. As a society we have not come to terms that without credit, we have a very hard time functioning. That is why even the mere hint of a rate cut makes the financial markets slap happy, since it postpones the inevitable for one more day. But is this really a healthy long term approach?

A Culture of Avoidance

This isn’t only seen in the economics of our consumerist society but also the psychology of other parts of our nation. Think of the avoidance of old age. Plastic surgery and cosmetics play into this desire of the forever young and give the perception that the fountain of youth has been discovered. But again, how appropriate to have plastic cover up the real you. Is this not what is occurring by funneling yet more credit into a market that clearly needs a massive 90210 makeover? There is no drug or surgery that is going to make this market look beautiful. Think of it as a Hollywood wild west stage. All looks real and strong but when you walk behind the saloon, you realize it is held up by a two-by-four.

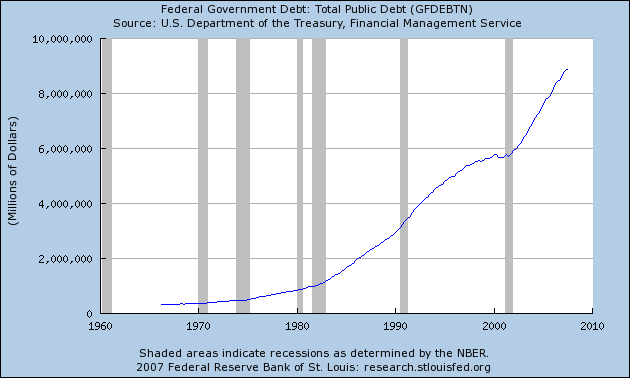

Take a look at the public debt:

Click Here, or on the image, to see a larger, undistorted image.

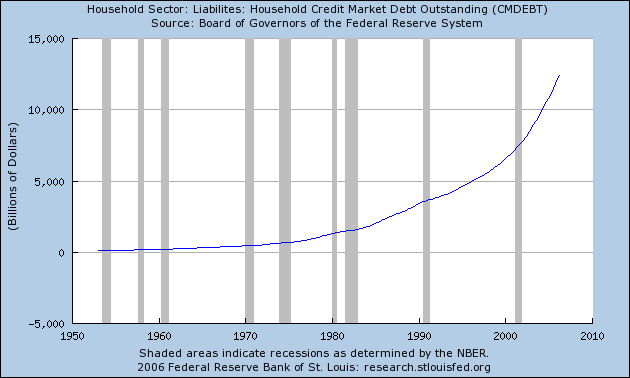

Follow this by taking a look at mortgage debt:

Click Here, or on the image, to see a larger, undistorted image.

Mortgage debt is at a whopping $13.3 trillion. Couple this with stagnant wages and you realize that people are subsidizing their current lifestyle via credit; mortgaging tomorrow to the hilt (pun intended!).

Delaying the Inevitable

As I’ve been reporting at least here in Southern California, short sales [[of houses. i.e., houses whose mortgage exceeds their value: normxxx]] have been increasing for the past 22 consecutive weeks. We are now over 12,000 short sales in the Southern California area and this doesn’t show signs of stopping. There was an interesting note that inventory did fall a bit, but looking at actual sales numbers we realize that people are simply pulling their homes off the market. Is this not a way of avoiding the main issue? There was a case on the A&E show Intervention of this woman who was $130,000 in credit card debt and had filed bankruptcy two times. We all realize that this person has some serious issues and the show of course brought this to light. Yet I am astounded that no blame was being assigned to the credit card companies. This is a person that has already demonstrated financial imprudence with not only one bankruptcy, but two and she was still able to spend. Does the 'lender' not have some sort of responsibility ? [[If that were alcohol or drugs, we would call them the 'enabler' or 'pusher'! : normxxx]] It is a co-dependent relationship and many in our society seem so addicted to this cornucopia of credit, that the thought of delayed gratification has become a foreign concept.

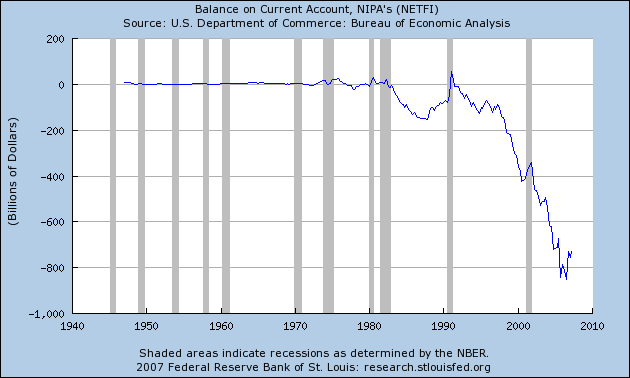

This imbalance is clearly seen when we look at our trade deficit:

Click Here, or on the image, to see a larger, undistorted image.

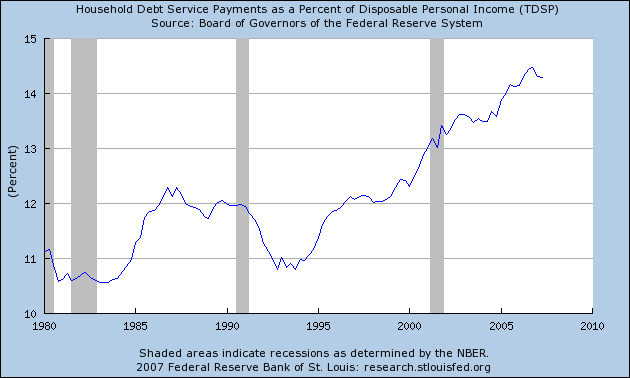

Just to offer you a direct example, in the month of October we had 323,131 20-foot containers coming into the port of Long Beach and 144,839 shipping out. A large potion of the items being shipped out are raw materials while we are bringing in boat loads of manufactured goods [[just like any other 'banana' republic: normxxx]]. Clearly this can not go on forever and these trade deficits will have to be faced. The argument may be that we are wealthier than we were in the past— yet a higher and higher proportion of 'disposable' income is going to servicing debt.

Click Here, or on the image, to see a larger, undistorted image.

Broken Window Theory of Mortgages

Some of you are already familiar with the broken window theory. Here’s a good explanation of the theory:

Or consider a sidewalk. Some litter accumulates. Soon, more litter accumulates. Eventually, people even start leaving bags of trash from take-out restaurants there or breaking into cars." |

How does this apply to the mortgage and credit crises we are facing? It won’t explain the economic reason in numbers but will help to paint the picture of the psychology of what got us to where we are. The problem should have been addressed when a few "broken windows" were appearing in the mortgage industry. The first 'stated income' [[aka, 'liar': normxxx]] loans. The early stages of fraud. Rampant speculation. An industry with no barriers to entry [[the mortgage broker industry; I believe the number went up by several hundred percent: normxxx]]. Wall Street greed. These things didn’t suddenly appear with the current market, but were certainly greatly exacerbated by the current climate and the credit addiction mentality [[how does that go? Wine, women, and song today, and the devil take tomorrow: normxxx]].

Think of the superstars who crash and burn with their multiple addictions. When you have money [[or, seemingly unlimited credit: normxxx]], it magnifies your good attributes (donating to worldly causes) or highlights your demons (drugs and partying every night). Think of the broken window theory and why it occurs. You see someone driving a leased BMW, taking on a $500,000 mortgage, and having 10 different department store credit cards. This is the rule rather than the exception in your neighborhood. So instead of littering, you can go for easy credit. It is easier to dive into debt when those around you follow suit. This is an observable phenomenon in sociology and goes back to the 1920s and "keeping up with the Joneses." We can even go further back with the Holland Tulip Bubble and South Sea Bubble so this is something that goes well back time and is seemingly inherent in human nature. But now that reality needs to be faced, instead of tightening our belts as a society, we are simply lowering the credit bar and trying to run on credit fumes [[at least until the next President's term: normxxx]].

I’m not sure what will actually happen in an election year, but the only solution which does not risk making the problem worse is getting our financial house in order; for example, with cram downs and the stopping of the credit addiction cold turkey. Isn’t it ironic that the perpetrators of the housing bubble are the same ones coming up with solutions? This is like asking a drug dealer for solutions to a drug addiction. It seems that modern politics isn’t about what makes the most economic sense over the long run, but what pleases the most voters now.

Hope Now Alliance: Press 1 for Subprime, Press 2 for Spanish.

Looking at a Hypothetical Case.

|

Let us give you a quick recap of what we know so far:

This will only apply to owner occupied properties with at least a 36 month ARM reset period or less.

- Loans must be originated between 1/1/2005 and 7/31/07. These loans must have reset dates between 1/1/08 and 7/31/10.

- The loan must be current.

- LTV must be greater than 97 percent

- The borrower must have a FICO score less than 660

- The borrower’s FICO score cannot be higher than 10% since the loan's origination date.

- Each servicer must determine the owner cannot afford higher payments.

Should you fall within this if-then statement of complexity, you will qualify for the 5-year rate freeze. So instead of a 2/28 mortgage we now have a 7/23 mortgage. In this post we will analyze our hypothetical case study of Johnny Subprime who meets all the above contingencies and has a scheduled rate reset on 1/1/2008.

|

This plan doesn’t even begin to address the potentially more dangerous mortgage bubble of Option ARM mortgages that are set to hit in 2010 through 2011. According to Fitch Ratings, 80 percent of Option ARM borrowers only make the minimum payment [[currently: normxxx]]. What this means is these folks are going negative amortization in a time where across the country every large metro area is seeing real estate depreciation. This is a guaranteed recipe for being underwater at a time when analyst are predicting the bottom of the housing market will be hit [[based on the current subprime fiasco: normxxx]]. It [[the ARMs fiasco: normxxx]] is literally the second tidal wave of this housing credit explosion.

But let us deal with one thing at a time. Let us run some assumptions just to show how this Hope Now Alliance will play out for Johnny Subprime:

Mortgage Type: 2/28 Mortgage

Origination Data: 1/1/2006

Home Purchase Price: $250,000

Mortgage Amount: $250,000

Mortgage Rate: 7 percent with expected rate at reset of 10

Current Principal and Interest: $1,663

Expected Principal and Interest at Reset: $2,173 *2/28

Taxes and Insurance: $260

Yearly Income: $50,000

Monthly Net Take Home Pay: $3,080

Car Payment: $300

Car Insurance: $100

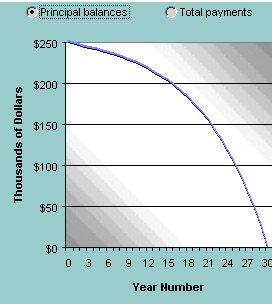

Auto Fuel: $120

Food: $400

We’ll leave out other factors like cell phones, healthcare, utilities, and credit cards which many borrowers have. With the current payment Johnny Subprime has disposable monthly income of $237. After talking with a counselor on the phone, Johnny hasn’t missed a payment and falls within the guidelines and demonstrates that a rate reset will suddenly put his $237 monthly surplus into a monthly deficit of $273. Since most subprime borrowers already start out at a higher rate, it is very common to see a starting rate of 7 percent especially if the note originated in 2005 or 2006 when rates were very low and the secondary market was buying them up like hotcakes. So instead of his rate resetting in 1/1/2008 it will now reset in 1/1/2013. Without the rate freeze the rate payoff curve looks as follows:

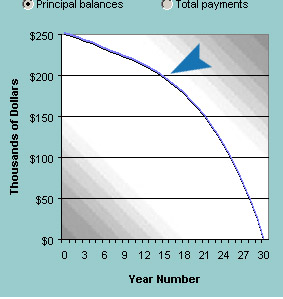

For simplicity, we will only assume that there is a rate cap of 10 percentthat doesn’t go higher— which latter has a very high probability, given the current economic circumstances and the structure of many subprime loans. Interest rates cannot remain at multi decade lows forever. So the freeze is on and Johnny lives to fight another day. Does this freeze really help long-term? Johnny goes on living his life, paying his bills, and doing the things of daily life. Let us assume that Johnny has received a 4 percent pay raise each year and now we are in 1/1/2013. How does our scenario variables change?

Current Principal and Interest: $1,663

Expected Principal and Interest at Reset: $2,112 *7/23

Taxes and Insurance: $260

Yearly Income: $60,800

Monthly Net Take Home Pay: $3,597

You’ll notice that the difference between the 2/28 reset payment and the 7/23 reset payment is only off by $61. So how is Johnny Subprime now doing in 2013? With the new rate reset he is now with a monthly surplus of $305. On the surface, it looks like the rate freeze has saved Mr. Subprime from losing his home. But there are many assumptions that we are assuming here.

Three Assumptions of the Hope Now Alliance

This seems all well and good for our hypothetical case. But as you can see from the tiny payment difference, all we are doing here is buying extra time in hope of a few things. First, there is no reason for Johnny Subprime’s salary to go up in the next 5 years. In fact, wages have recently been stagnating. If and when the economy goes into recession, there is even less of a reason to assume wages will increase as the economy contracts. This puts one major dent into this freeze plan.

The second assumption is that housing prices will stabilize over this timeframe. Who is to say prices will stay the same? In fact, we have another major mortgage debacle awaiting us in 2010 and 2011 just when this one is getting cleansed from the system. We are already seeing that yes, real estate does go down and in fact can go down on a national scale. Estimates abound that home prices can fall anywhere from 10 to 30 percent depending on the area. Many analysts predict the bottom somewhere in 2010 but of course the dormant giant of Option ARMs hasn’t even been tackled. So assuming Johnny Subprime’s property falls by 10 percent nominally, he will still owe $227,868 on the new 7/23 mortgage and the property will be worth $225,000. He will have zero appreciation and will lock himself into a place for 7 years. As you can see, sometimes renting is better than buying. After all, having a roof over your head and building up no equity is the simplistic definition of renting.

The final assumption here is that Johnny will in fact want to stay in his home. We’ve heard countless times from the industry how no one ever stays in one place anymore. Well in this case, Johnny will not have much of a choice in the first few years since he doesn’t have the equity to sell, especially in a declining market. What if he gets a new job somewhere else and needs to move? Is he going to be compelled enough to stay in the place? What if he realizes that the only true winner here is the lender and he in fact may be coming out with no equity in the end? Will he want to continue making payments to keep the lenders afloat?

|

You can see that it is much too early to determine how this thing will go. Will people in foreclosure that don’t qualify for this plan call for equality? Why should they be punished because they didn’t fall within the given timeline of the current proposal? What about prime borrowers that are underwater? Why shouldn’t they be able to freeze their rates as well? Again these are philosophical questions more than economic but I assure you they will come up in the coming years. Even though this isn’t a bailout per se, it does open the door slightly for more government meddling. We already know that Paulson said this isn’t a "Federal bailout" but the wording giving tax-exempt status to states should be watched. Another major thing that would be a bailout is what Angelo Mozilo, CEO of Countrywide mortgage is pushing. He is calling for caps to be raised to $625,000 so the FHA, Freddie Mac, and Fannie Mae can purchase larger mortgages. Mozilo had actually called for raises of as much as $850,000. Since Countrywide and WaMu have nearly 45 to 50 percent of their mortgages in California, I wonder why he is pushing this so hard?

What are your thoughts? Is this a bailout or is this something more benign?

ߧ

Normxxx

______________

The contents of any third-party letters/reports above do not necessarily reflect the opinions or viewpoint of normxxx. They are provided for informational/educational purposes only.

The content of any message or post by normxxx anywhere on this site is not to be construed as constituting market or investment advice. Such is intended for educational purposes only. Individuals should always consult with their own advisors for specific investment advice.

No comments:

Post a Comment